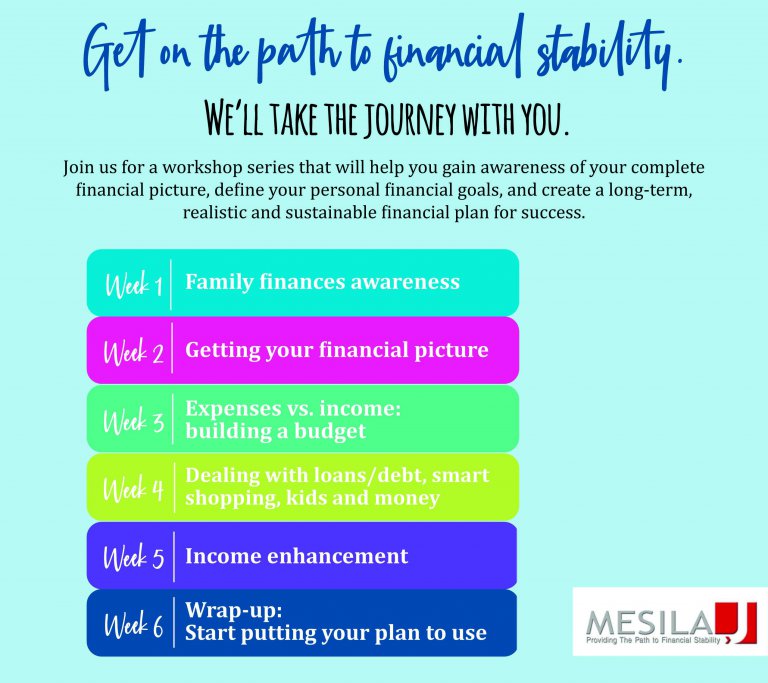

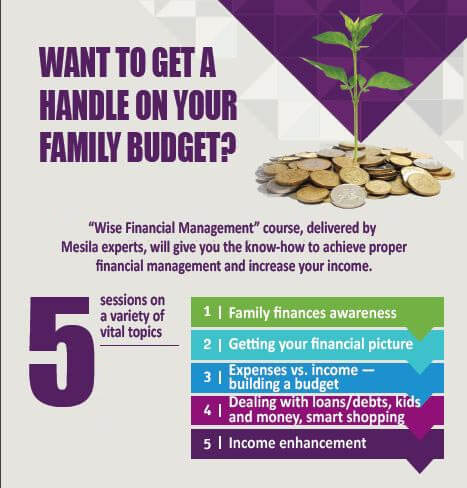

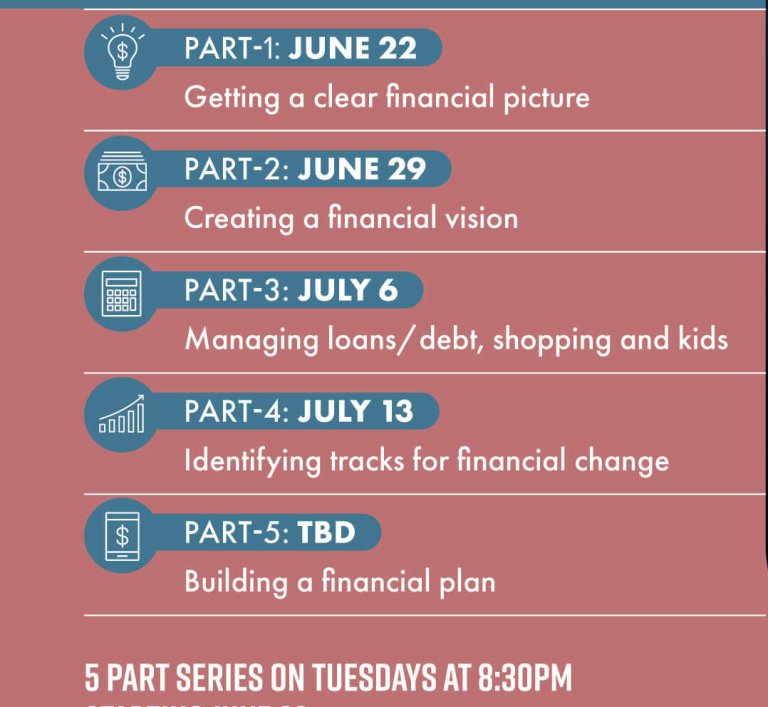

- Getting a clear financial picture.

- Monthly Income and expenses.

- Periodical income and expenses.

- Overall debt situation.

- Identifying challenges.

- Creating a financial vision.

- A powerful, motivating description of your desired financial reality.

- Short term, medium term, and long term goals.

- The price of your vision.

- Identifying tracks for financial change.

- Income enhancement

- Streamlining expenses

- Thinking out if the box

- Emergency Budget

- Lifestyle change

- Building a short-term and long-term budget.

- Actual implementation of monthly budgeting.

- Tracking your budget and tweaking when necessary

- Cash flow challenges

- Paying off debt.

Of course this is all if time allows.

– 12 steps to financial stability

– Practical tips

– How to form a financial management plan

– Dealing with debt

– Becoming a super-saver